Best Financial Affiliate Programs

Introduction

Financial services are a very important part of every economy of all countries in the world. Without financial services exchange of money, goods and services will not be the same as you are seeing today. Financial services are literally the backbone of any economy. These services are responsible for loans, interests, finances, and every other thing that is related to money. The services that are provided by the finance industry are called financial services.

Each and every organization that deals with any type of money management is considered to be a financial service. Financial services include a wide range of businesses that manage money. These businesses include banks, credit card companies, consumer- finance companies, investment funds, credit unions, stock brokerages, accountancy companies, and enterprises that are sponsored by the government. All these companies provide all kinds of investment and money-related services. Looking at all this it is no wonder that these finance services earn the most money as they hold the world’s largest market resource.

Most people feel that financial services are just limited to loans, investments, and deposit services but that’s not true at all. Estate, agency services, trust, insurance, and various securities are also a part of financial services. For that matter, any form of financial intermediation or market intermediation regarding any financial product is a financial service. But the services offered by the finance industry are of high risk which contains regulatory pressures, along with a huge market. With all these factors in its line of work, the final services are striving to grow even more and increase the value of its shareholders. The expectations and needs of all the customers are increasing and changing with each passing day. The main reason for this is the rapidly growing population which is really mature, the increase in personal wealth of people, and increasing demand for financial products and services that are more personalized which can satisfy the user’s desires.

There has been a lot of competition in the financial services industry for the last two decades. This competition has resulted in companies cutting costs and at the same time improving the quality of the customer service and choice. The competition between financial firms is forcing them to be more innovative and making them look for great talent. The risk of a financial service keeps increasing depending upon the complexity of the service. The more complex the product the riskier it is. But due to the pressure put on by the government and public the regulations of the financial services are available also tightening. The financial services that we stand out the most are the ones that are the most accountable and transparent. Only the companies that can adapt to the rapids changes in the market can survive and earn profit in the financial services industry.

In order for that to happen the financial firms should learn to see the challenges as opportunities to get stronger. They must use their creativity to improve their risk management techniques and deliver returns that can boost confidence in the market. The global finance industry is developing due to this every financial service needs advanced solutions to perform real-time action without leaving any room for errors. Even the market has to keep up with the advancements of the financial services if they want the best products and services. They must always be efficient and proactive in incorporating technological advances while reducing the risks and costs. Financial services have been one of the most integral parts of a wide range of business products and services. Every year the financial services industry earns hundreds of trillions of dollars.

The financial services industry’s market is the economic force behind many businesses. It decides the operations, success, and standards of other industries. All the practices, regulations, purposes of a company’s business, and their customer’s business are influenced by the financial services. If a financial service wants to have a more effective network then it has to be customer-oriented. This helps any organization is a great way as it is very effective in increasing alertness, profitability, and decreasing the cost of total ownership of an organization. There are lots of companies that are constantly working to develop a great network between financial service companies so that they can offer the best service to their customers. Not only customers but also partners, suppliers, and employees so that they can have better transactions. Financial services is an ever-changing dynamic industry. It is a very diverse and high growth market. Anything it may be an individual or group, credit cards, banks, consultants are all part of financial services.

Why do we need financial services?

Financial services are very important for any country’s economic growth. The financial services help to increase the productivity of all sectors which improves the economic condition of a country. This will directly affect the common people of the country. Due to economic growth, a person will be able to enjoy a high standard of living. This will enable people to buy more products and services from various businesses. During all these activities there are a lot of financial institutions that earn the profit. These financial institutions are responsible for the promotion of savings, investment, and production in a country.

The increase in the demand for the products is created by financial services. To meet the demands of the consumers, the producer will be needing more investment. During this time the producers go to financial services to get more investment for their companies. Financial services like merchant bankers will help the producer to get more capital. The stock market will help the investor to get more investment. Financial services like mutual fund savings provide different types of savings options. Not only savings but there are also different types of investment options for the people. These investment options are very helpful for senior citizens to get reasonable pensions with low risk every month once they retire. Apart from that, there are many other great reinvestment opportunities for people. Each and every citizen’s savings are protected by the government as the laws to regulate the working of various financial organizations are under its control.

Most of the major businesses are assured to have maximum returns because of financial services. This is because the financial services provide credit to the customers at reasonable rates which enables them to spend more money on goods and services. In some cases, the financial services also lease some assets if they are of high value. The economy can only be developed if all the sectors are developed properly. The primary, secondary and tertiary sectors are all provided equal amounts of funds by these financial services. This ensures that there is a balance between all these sectors which results in improved employment opportunities. The standard of living of people is improved when people are able to afford products and services. House financing and leasing help people to purchase things like houses, cars, and other things they need. This will automatically make the consumers save money as they have to pay the money back.

The insurance companies are life saviors for most companies as they minimize their risk. Businesses are always fluctuating, you never know when a business is going to have a hard time. The financial services offer protection to these companies during these times. Not only that, but the insurance companies also cover damage done in case of natural calamities. Many people look at insurance as finance but it also acts as good savings which automatically minimizes the risks. Even governments benefit from financial services. These services help the government to raise long term and short term funds. This helps the government to meet both capital expenditure and revenue. Short term funds are raised by issuing treasury bills which are purchased by the commercial bank using the money of their depositors. Long term money is raised by selling government securities in the security market. The requirements of the foreign exchange market can also be met by governments. Many financial services contribute to the promotion of foreign trade.

Financial affiliates cannot be clubbed into marketing a particular type of financial service. Because there are many types of financial services that have affiliates. One must clearly understand what are the different financial services and what they do in order to promote them. As this entire article is about financial affiliate programs you must have an idea of what kind of financial services you are dealing with. This will help you to choose the best among financial services affiliate programs that suit you so that it is easy for you to promote them. The following are some of the most common and important financial services out there.

Different types of financial services

Banking

This the first thing that comes to everyone’s mind when they hear the word financial services and rightly so. The banking industry is the most important financial service in any country. It is literally the backbone of the finance industry. There are banks that belong to different sectors like the public sector, private sector, urban, rural, regional, and foreign sector banks. Most of the financial services offered by these banks are similar. Their services include individual banking which involves saving accounts, checking accounts, credit/debit cards, etc. Another service offered by them is business banking which offers checking and savings accounts for merchants, checking merchants, treasury services, etc. The other most important services offered by them are loans. These banks offer various types of loans such as home loans, personal loans, automobile loans, business loans, and many more.

Insurance

Insurance is one of the most important financial services for any individual or business these days. Anything and everything thing are being insured these days. There are only a few people who are not subscribed to any type of insurance plan in the current generation. Almost everyone has some kind of insurance which is a great thing. Because you never know what is going to happen to you or your business. Anything can go wrong at any given moment and might lose all you have and most importantly you might lose your life. How are you going to manage in those situations if you don’t have a security or backup plan? You can’t. This is where the insurance companies step in. Insurance companies safeguard business organizations and people against different types of accidents and circumstances that you won’t expect. However, the payouts of these insurance services differ depending upon the nature of products, assessment, premiums, customer risk, and many other aspects. There mainly two types of insurance policies the first one is general insurance and the second one is life insurance. General insurance covers the activities related to fire, medicine, travel, home, and others. Life insurance is related to pension plans, money back, unit-linked, term-life.

Tax consulting

This type of financial services includes a lot of activities regarding auditing and tax domains. These services are differentiated on the basis of businesses and individuals. The services for individual tax include determining the liability of tax, advisory in tax savings, filing for tax returns, and many more. Business tax involves the structuring of pricing analysis, transferring of pricing plans analysis, determining the liability of tax, advisory for tax compliance, etc. If you are talking about the auditing segment then it has totally different types of services. The solutions offered by it include stock audits, internal audits, tax audits, statutory tax audits, service tax audits, etc. These financial services make sure that business operations run smoothly in a qualitative and quantitative manner with minimum risk.

Mutual funds

Many people tend to think that mutual funds are a very complex idea but it is not as complicated as people assume. Mutual funds are basically the money gathered by a large set of people. All these funds are managed by a professional called fund manager. The money is collected by the trust of a group of people who have the same objective. After collecting the money all of it is invested in securities, bonds, equities and etc. All the investors get certain an amount of money that is generated through the total investment. Each person gets money depending on the amount they invested and a small amount of money will be deducted from it to cover some expenses.

Wealth management

This type of financial services involves management and investment of money of the customers in different kinds of financial instruments. They invest and manage money in various segments like real estate, insurance, products, mutual funds, equity, commodities, etc. All of this is done based on risks, time horizons, and financial aspirations of the customer.

Advisory

This type of financial services offers professional advice on financial matters to businesses and individuals. The advisory consists of various services like risk consulting, investment due diligence, real estate consulting, valuation, M&A advisory, taxation consulting. There are lots of services like this in every country. Financial advisory is provided by large organizations or an individual consultant.

Now that you have an idea of what are financial services and what are the different types of financial services out there let’s jump into the topic. Below is a list of best financial affiliate programs.

Turbo Tax

Turbo Tax is an organization that simplifies the tax-related issues so that their customers can understand and deal with them easily. Calculation of taxes and understanding how to deal with them is not an easy task this is where the Turbo Tax comes in. All the customers who have access to turbo tax can ask all the doubts and questions that they have about taxes and Turbo Tax solves all their problems. If you want the best solutions for the problems you encounter then Turbo Tax demands you to provide accurate information about the situation you are facing. The calculations can be made for any level or scale of situations and money. It can provide solutions for both businesses related issues or issues that are faced by an individual. For example, if you are an individual and expect some solution then you have to provide information like the job you are doing, the amount of salary you get, the number of children you have, etc.

Turbo Tax is very confident in its approach and promises to provide the best solutions for its customers with accurate calculations. The company promises to do this providing solutions that are suitable with respect to the current financial laws and regulations. Turbo Tax always keeps itself updated with any changes that happen in tax laws. But promoting Turbo Tax becomes tough when you look at the price it demands to offer its services. So you have to be very careful on how you aim to promote it and whom to promote it. There is a free version of Turbo Tax which allows its users to file Form 1040 but you cannot do other stuff. If you really want to have solutions for all problems related to tax then you have to subscribe to one of their other four plans. Those versions will allow a customer to get solutions related to things like alimony, retirement contribution, deductible student loan interest, business income, alternative minimum tax, lifetime learning credit, etc.

Turbo Tax is one of the leading financial services companies in the tax return industry. One can easily say this after knowing that they have 31 million users every year. This is a great reason to promote this service. It makes it very easy for people to file their taxes without going through all the hectic process. This is a huge advantage when you are promoting Turbo Tax as they have a great affiliate program for marketers. But you have to know in advance that the commission rates and duration of cookies are not very huge. The maximum commission one can earn is 15% for every successful referral. But you have to keep in mind that the cookies only last for a week so you have to be very smart while marketing it. The best part about it is you can easily have successful referrals during tax season as people will not think much about purchasing Turbo Tax during that time. Many marketers may back out looking at the commission rates but you have to keep in mind that you are promoting a trusted brand.

Quicken loans

If you go based on the sheer volume of loans then Quicken Loans is the largest mortgage lender in the entire USA. The services offered by this lender to its customers are conventional mortgages, federal housing administration loans, jumbo loans, department of veterans affairs loans, department of agriculture loans, and also reverse mortgage loans. Quicken Loans has an online mortgage program called Rocket Mortgage. This program is really helpful for its customers as it allows them to share details about their income and assets with partners of Quicken loans. There is a specialized mortgage loan offered by Quicken loans called YOURgage. This loan allows the borrowers to choose the ideal time period for them to repay the loan. The term of repayment can be anywhere between 8 years to 29 years. This will allow the customers to tailor their monthly payments depending on how much they earn every month.

Quicken Loans has a feature called mortgage calculator which allows people to calculate the mortgage of a property they desire. They just have to type in the zip code of the property, their annual household income, estimated down payment, credit score, loan term, and the mortgage calculator will tell you how much the mortgage is. As a marketer, you have to keep in mind the minimum FICO credit score and debt to income ratio required to qualify for a loan from Quicken loans. The person who wants a loan should not have a FICO score of less than 620 and the debt-income ratio should not be more than 50% if they want a conventional loan of 30 years. FHA loans are given to people who do not have a credit score of less than 580 and their DTI should be 50% or less. Each loan varies depending upon the product and Quicken loans also don’t charge any penalty for any of its loans on prepayment. It also has a feature called rate shield which helps the borrowers to lock the interest rate on their loans for 90 days while they find the home they like. They can also lock a lower rate if the prices decrease in the market while they are searching for a home.

Here’s why Quicken loans are one of the best financial services affiliate programs. It is the largest and very well known mortgage service in the US. Quicken Loans has been given an A+ rating by Better Business Bureau. It is one of the best and most popular mortgage companies out there. All these things are very helpful for a marketer while promoting Quicken loans. In fact, all these things make it easier for an affiliate to promote this service. The best part about this after joining Quicken loans people can complete the whole process of mortgage online. These processes include application, account management, approval, closing, and others. Even Quicken loans were formerly owned by Intuit so it is no surprise that many people go to Quicken loans for a mortgage. Their popularity is what makes the affiliate program of Quicken loans so desirable. An affiliate gets different types of commissions depending on different referrals. If you are in affiliate marketing you can make anywhere between $5 to $15 for each successful referral. Another best part about Quicken loans affiliate program is its cookies last for 90 days.

Lending Tree

Lending Tree is an organization that offers financial services such as personal finance and other tools. Its services include providing the necessary information regarding credit cards and credit card scores. This company provides people with an alternative way to borrow money. All the loans from this service come from small companies and individual investors along with some traditional lenders such as banks. This is a great deal for the borrowers as they get lower interest rates. Borrowers get lower interest because all these different lenders are in competition with each other. They can even get loans through Lending Tree even if several banks reject their loan application. Lending Tree acts as a matchmaker between lenders and borrowers. All it does is it introduces borrowers to lenders to do this Lending Tree collects a small fee for its services. Keep in mind that Lending Tree is not the one that offers loans or credit. It is the different parties associated with it that offer loans to borrowers.

Lending Tree offers loans that are standard and depending on which type of loan you require the information you have to enter changes. For instance, if you need a personal loan you will have to state the purpose of the loan, major purchases, vacations, and etc. After that, you have to specify the amount you need which can be anywhere from $1000 to $3500 along with your estimated credit rating. Then you have type in your address pre-tax income, personal information, email address, and type of residence along with the last four digits of your social security number. It then asks the applicant a series of questions to confirm their identity. After this, the applicants will be shown all the offers that are available to them. Not only the offers but deals offered by each lender including the lender’s name, the amount, number of years to repay, and monthly estimated payments along with the phone number of the lender Just in case if the applicants want to call them to clarify some issues.

Lending Tree deserves to be on this list of best financial affiliate programs because it has one of the best affiliate programs for debt settlement. This is a great affiliate program for marketers who promote niche businesses. It is a great site for affiliate marketers to promote as it is not a financial service like banks that offer loans on fixed conditions. Lending Tree is a site where users can compare the different prices offered by various lenders for credit cards, insurance products, home loans, and personal loans. This is a great site if people do not know where to get loans. It is great because people don’t have to go to different lenders to apply for loans. Even the commission rates offered by Lending Tree are great. An affiliate can earn up to $70 per each lead. The only downside is the cookies last for only 14 days.

Ally Invest

The next financial service that has got the best financial affiliate programs is Ally Invest. This financial service is a great option for investors who are both beginners and the ones who are experienced in stock trading. The biggest advantage for affiliate marketers to promote it is $0 minimum account and $0 trading costs which helped it to gain the reputation of being one of the best low-cost brokers. Ally Invest is not just another online broker it offers various features for its users which helps them in trading. It provides its users with features like bells and whistles that are offered by forex trading, a suite that consists of free tools for technical investors. Ally Invest is the best option to promote for affiliate marketers whose audience are active traders, forex traders, and options traders. It was in October 2019 when Ally Invest dropped all of its trading commissions to $0 for ETF trades, options, and online stock. The $0 of the minimum account balance is great for investors who are at the beginning stages of trading.

Trading through Ally Invest is very easy as its browser-based platform offers the users real-time streaming quotes, trading capabilities that are quick, and data. Not only that but it also provides a dashboard that is customizable and access to all the tools of a broker. This is a great service for users who trade through various devices in the home, office, or some other places. Since it is a web-based platform there is no need for downloading. What’s more interesting is that you don’t have to have a computer to trade. Anyone can trade from anywhere through Ally Invest as it has two applications for mobile devices. These applications are namely Ally Forex and Ally Mobile among these applications Ally Forex is specially designed for forex trading. Ally Invest offers its customers a suite of free tools that help in investing.

The options trading tools which are offered by it are very strong which consists of a pricing calculator. Using this pricing calculator one can compare the current prices to predict values. It also offers a strategy scanner that is able to identify and execute option strategies based on the chosen criteria. Not just investment but Ally Invest also offers several other financial services like online savings, auto loans, and home loans. But these are not the services they are mostly known for. So if you want to promote Ally Invest you must promote it as a platform that specializes in stock trading. There are two options from which the investors to choose from. The first is self-directed trading which is great for experienced traders and the second is a managed portfolio which is investors who are starting to learn the trade. It is a great financial affiliate program for marketers as it offers more than $900 EPC. An affiliate can make anywhere from $25 to $50 commission for each lead. It also has a great cookie duration that is 45 days.

Kabbage

Kabbage which was founded in 2009 is another financial service that offers payment services and lines of credit to businesses. Kabbage has gained popularity as one of the most convenient lenders out there. It is not very difficult to get credit for your business if you are using Kabbage. All you have to do is apply, decide on the rates and fees offered by them, and withdraw funds all of which happen in a matter of minutes. This type of service is not seen even by services that are known to make swift lending decisions. Which is a great thing that you can use while promoting it. But one has to pay a huge price due to this quick transaction. The interest on the borrowed amount can reach up to 10% every month. Kabbage provides some of the most expensive loans you may come across. Even though it does not have a prepayment penalty you cannot save much money if you pay early. This is because all of its loans are front-loaded.

But you don’t have to worry to promote Kabbage even if it is not low cost. There are a lot of other features of Kabbage that make it more desirable. The Kabbage application is in fact very fast and easy to use. You can repay your credit on a monthly basis. The line of credit offered by cabbage is the easiest way to access the market. In addition to this, you can request funds through a desktop or its mobile application. Kabbage also offers a spending card so you can pay the amount through the credit line. All these things are great for promoting Kabbage.

This financial affiliate program is more suitable for the niche market as it targets all kinds of consumers. It is a company that has gained the reputation of funding small businesses. The best part about promoting Kabbage is the commissions it offers. An affiliate can easily earn a couple of hundred dollars if they refer qualified accounts to Kabbage. This service is great for affiliate marketers whose audience consists of entrepreneurs and small business owners as it can be very useful for them. You will get paid $250 for every qualified account you refer to. Even the cookie duration of Kabbage is great, they last for 45 days.

Peer Street

The next financial service on this list is Peer Street. It is P2P that brings borrowers and investors together onto a single platform through its website. This company is known to create real estate loans. It is an online platform where an investor can invest in private real estate loans that are of high quality. The main aim of Peer Street is to take real loans into the niche market which is not a place where you see your usual investors of real estate. Peer Street focuses on loan investments of private money. They do this because they believe that risk on an asset price is always misrepresented to be in favor of the investors. Peer Street offers people loans in a way that minimizes the risks involved in such investment. No one wants to be at risk while investing in real estate. So this is a great feature that can easily be used by the affiliate marketers to promote Peer Street.

This company is very different compared to any other real estate investment service because it offers the investor to choose loans that they want to invest in. Peer Street gives its users the ability to choose their loans. It also helps them in building a portfolio that is based on their own set of preferences and parameters. Anyone who uses Peer Street can make use of their investment function which is automated. All you have to do is set your preferences and parameters the investment function will take care of the rest. The loans will be automatically added to your portfolio based on your parameters and preferences. All these features are extremely useful for investors so use them to promote it. One can say that Peer Street is a real estate investment platform that crowdfunded. One can start their portfolio in real estate investment even at $1000. Even the affiliate program of Peer Street is different from others. An affiliate will be paid $30 for each successful referral and they also have a good EPC of $67.87. A marketer does not have to worry about cookie duration as they last for 45 days.

MarketRiders

MarketRiders is a web-based software program for investment which was founded in 2007. This company which was founded in Chesterfield, Missouri, helps people to create a retirement portfolio that is of low cost and globally diverse. Apart from making your recommendations for investment allocation, it helps you to avoid all kinds of unnecessary fees. MarketRiders is a service that has thousands of subscribers all of who have worked to build more than 15,000 portfolios whose valuation is more $5 billion dollars. The main goal of the company is to help elderly people to solve their problems. At the same time, the site explores the idea of people being able to control their own money and doing trade in their own way rather than giving their money to a manager in hope that it goes well for them. There are two options you can choose for management. You can either choose managed services or you can choose the Do-it-yourself service.

If you choose managed services then your money is held by Soho Trade. It clears all of its trade through Apex Clearing Corp which is its clearing firm. If you choose Do-it-yourself service then you have to work with your own broker. Similarly, if you managed services your account is protected by Securities Investor Protection Corp. You will be $250,000 in cash if you encounter any failures. All the investments made on MarketRiders are based on Modern Portfolio Theory. This theory looks for ways to optimize investment while mitigating risks. One can only accomplish this by assets that belong to classes that are uncorrelated.

Every portfolio created by MarketRiders has a bond exposure that ranges from 10% to 90% depending upon the type of investors. All these features have to be highlighted if you want a successful referral. It is a very reputed web-based investment software that is used by many investors. MarketRiders is the best software program you can promote if your audience consists of investors. An affiliate can earn anywhere from $15 to $30 for each referral. The duration of cookies is great as they last for 90 days. All of these things make it one of the best financial services affiliate programs.

LifeLock

LifeLock is a very different financial service compared to all the other financial services on this list. It is not an investment or a loan lending platform but it is concerned with issues like identity theft monitoring, recovery, and alert services. The services offered by this platform aim to find the problems and help you solve them. The best way to prevent anyone from stealing your personal information is to freeze your credit files with all three major credit bureaus. It is a very effective way to stop your information from getting stolen and it is also done for free. But using LifeLock has its own perks like one does not have to constantly monitor their credit card. LifeLock will do it for them without freezing their credit card. It will help you resolve if there are any security issues or identity theft. All LifeLock does is it alerts you on potential threats, looks for all signs of identity theft by monitoring credit files. After finding any threats or issues it will help you solve the problem.

LifeLock does this by scanning your social security number and other personal information that can be identified online. It alerts you on all kinds of issues that can be basic or esoteric. All these things can be done by individuals themselves but they don’t have time to do them. This is where the LifeLock comes into play, it will do all those things for people. You can use this to your advantage if you want to promote it among your audience. An identity victim loses $1300 on an average. More than 100 billion dollars are lost by people across the world every year due to identity theft. This will give your audience a great reason to subscribe to this service. The only solution for identity theft is to stop it before happening and LifeLock is great at it.

LifeLock monitors the accounts to detect any kind of changes in credit files or addresses and personal data. They offer up to $25,000 reimbursement if you become a victim of identity theft while using their service. What more do you want to successfully promote an identity theft service? Its commission rates are also great as they pay $110 per sale and have an EPC of $310.08. The duration of cookies is also not bad as they last for 30 days which automatically makes it one of the best financial affiliate programs out there.

Credit Sesame

The next financial service on this list is Credit Sesame which has been around since 2010. It offers many free services that help people in managing their credit by providing important information regarding their savings accounts and other financial services. This company acts as an advocate to its consumers helping them in reaching their financial goals. The first reason to promote Credit Sesame is it is completely free. Because of this, it will be very easy to promote and convince people to subscribe to this financial service. This makes it one of the easiest financial affiliate programs to be a part of. Apart from that, it is also very easy to sign up for Credit Sesame and it will instantly give you access to identity theft protection, credit score, provide you personalized savings advice, and many more. The ability to access your credit card has to be one of the best features of Credit Sesame.

Another best thing about using Credit Sesame is that it does not affect your credit card score. Since all these things revolve around your personal information it has a soft inquiry that will not have any effect on your credit in any way. There are a number of factors that impact your credit card score. Credit Sesame helps you in understanding how the history of your personal credit affects your credit score. Credit Sesame also provides recommendations on how to maintain and improve the credit score. It also alerts its users every time their credit score changes. These features can be stated while promoting this service to get people to subscribe to it. Apart from all these things Credit Sesame also helps its users in identity theft protection. These services are used by people who need them the most and it has undoubtedly got one of the best financial services affiliate programs. An affiliate is paid $6 for every registered user and its cookies last for 30 days.

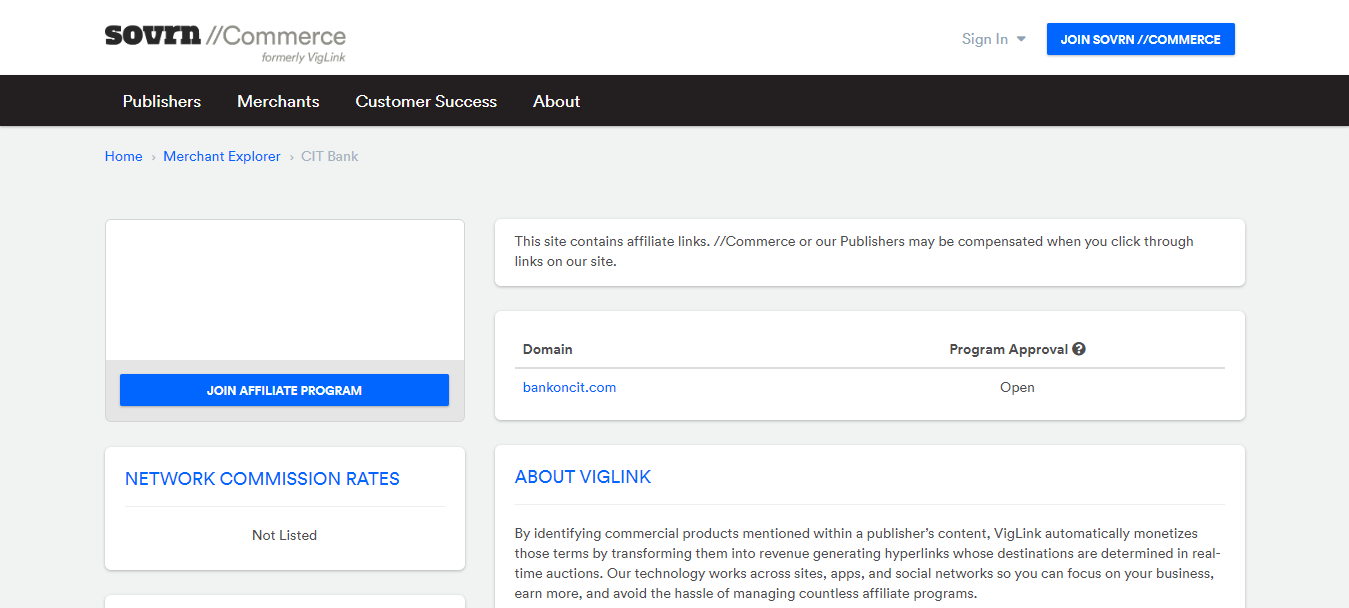

CIT Bank

The last entry on this list of financial services with the best affiliate programs is CIT Bank. CIT Bank is a well known online bank that has notable checking accounts, certificates of deposit savings accounts, and high yield savings options. One does not have to pay any kind of monthly fee for using CIT Bank. You have to take into consideration that all of their interest rates are competitive while promoting this financial service. One thing that is not available with CIT Bank is that it has no free ATM network which you won’t find in any online banks that have checking accounts. It has money market accounts which are a type of savings accounts that are part of several money-saving options of CIT Bank. You will earn the same amount of money irrespective of the balance in your account. Many money market accounts often demand more than $2500 to earn at higher rates.

It does not charge you any monthly fee but you need to have $100 for opening a money market account at CIT Bank. It also has a premier high yield account which will earn 1.00% APY without any monthly deposit conditions. All of these accounts require just $100 to open. Another great advantage of using CIT Bank is that it offers $30 reimbursement every month for outside ATM fees. The easiest reason you can state to get people associated with CIT Bank is it does not require any minimum balance to avoid monthly service charges. This financial service has been around since 1908 and it is still going which makes this service easy to promote. It is a well-reputed financial service so won’t have much problem while promoting it. The bank which survived several global conflicts and two recessions has got one of the best financial affiliate programs.

In all these years CIT Bank has diversified the type of financial products they are offering their customers. Not only personal savings CIT Bank also offers mortgages. There is a reason behind calling it one of the best financial services affiliate programs. An affiliate is paid $100 for every successful lead they send to CIT Bank. Which is great for any affiliate program and it also has an EPC of $579.87 which is outstanding. The cookies offered by it last for a duration of 30 days.

Conclusion

There are many types of financial services that are present in a country. All these financial services play a huge role in the development of a country and improving the living standards of the people. There are various types of financial services each offers services that are different from others. It is up to the consumers to choose a financial service that suits their needs. But there are many financial services that can be very useful for people but they do not use their services. This happens because consumers do not even know that these services exist in the first place. But this is a great opportunity for affiliate marketers to promote these services and make some good cash. All you have to do is understand your audience and promote financial services that can be useful for them. You have to always keep in mind what is type of financial service you are promoting and whether it is useful for your audience. If you get it right you can easily earn a lot of money through commissions. Hope this article has helped you in understanding what are financial services and how to select the best financial services affiliate program that you can easily promote.